Category - Business Tax

End-of-Year Business Tax Planning Checklist

Changes to 2017 Tax Cuts and Jobs Act (TCJA)

Time-Saving Tax Tips to Simplify Your Filing

What the IRS Is Focusing on in 2026

NEW!

Managing Estimated Taxes When Income Fluctuates

NEW!

How Technology Expenses Are Treated for Tax Purposes

NEW!

Common Business Tax Audit Triggers and How to Avoid Them

Navigating Multi-State Business Taxes

How Tax Credits Can Offset Rising Business Costs

Expanding Your Business? Don’t Overlook These Tax Considerations

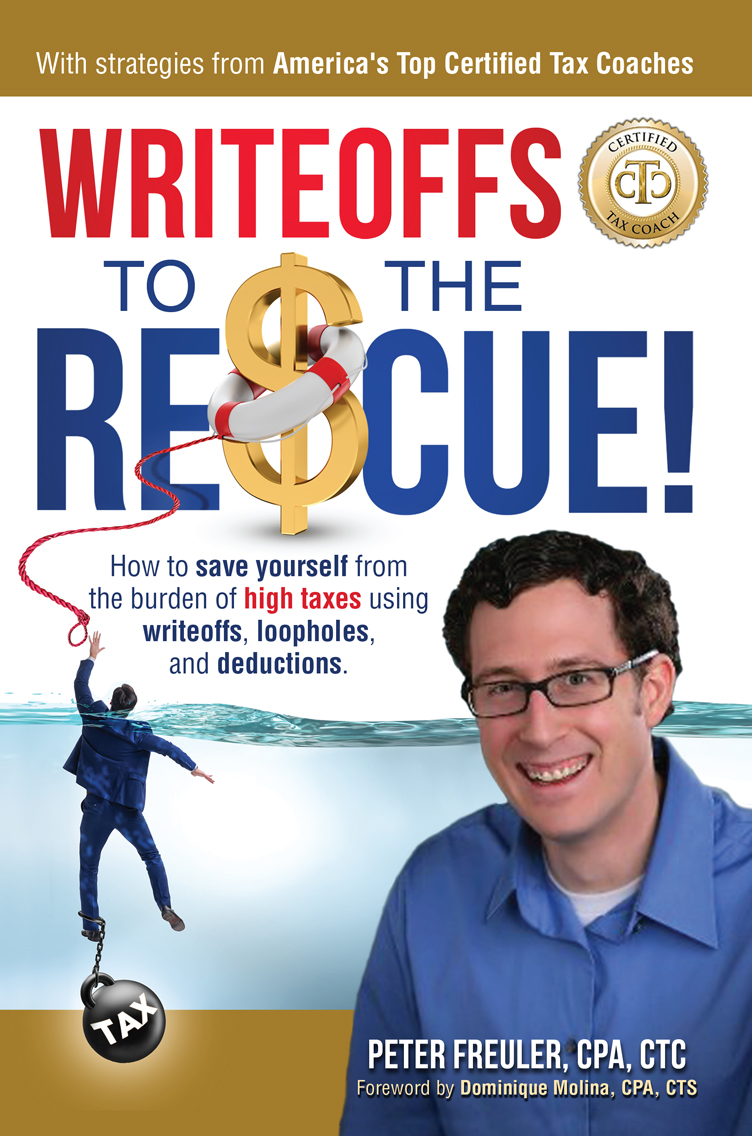

Business Tax Reduction 101: Smart Strategies to Keep More of What You Earn

Understanding Your Tax Obligations When Starting a Side Gig

Business Tax Planning for Tax Cuts and Jobs Act (TCJA) Sunset

The Benefits of Hiring a Professional Tax Advisor

Maximizing Your Small Business Tax Return

Unpaid Payroll Taxes: A Common Small Business Mistake

Separating Business and Personal Expenses